Changes to implement support for practitioners paid as an expense to the practice (Accounts Payable Practitioners, such as some Locum arrangements)

User Story

- Increasingly, practices are including accounts payable adjustments on distributions to practitioners. These could be for expense reimbursement, for registrar supervision, on call rates, or top up payments to guarantee thresholds.

-

Also, many medical practices engage practitioners under consulting or expense relationships, where the practitioner might be paid a percentage of billings or receipts as an expense to the practice.

- While less common than traditional service fee arrangements, these distributions necessarily require different accounting treatment, and thus different presentation formats.

Solution

- Surgical Partners is gradually formalising support for an increasing range of these 'accounts payable' arrangements, as we have for Guarantee top up payments for some time.

- This has required a change in layouts of the Surgical Partners Hub user interface, to more accurately reflect the nature of these transactions and adjustments, and to contextualise the tables and export files such that they can represent these broader information types.

- The below framework sets out the changes, grouped by page or export location:

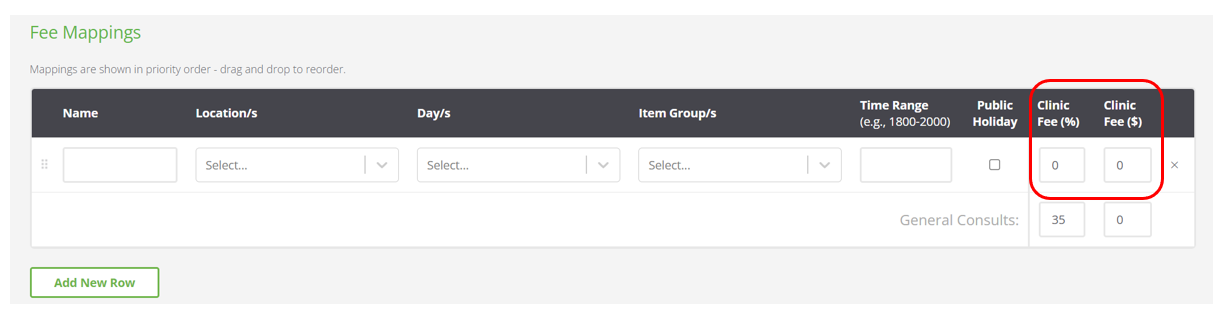

Fee Mappings in the Practitioner Setup Page

- Fee mappings everywhere no longer say ‘Service Fee’, and instead say either ‘Clinic Fee’ (AR) or ‘Practitioner Fee’ (AP).

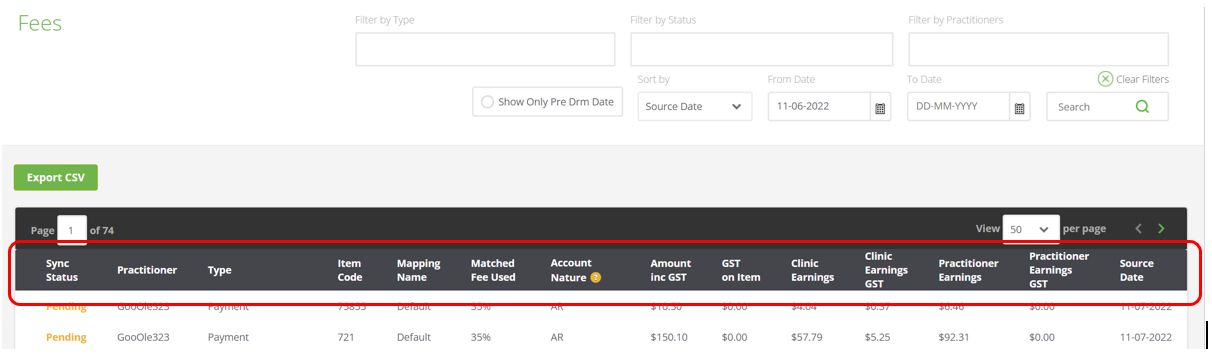

Changes to Table Headings and Contents in the Fees Page

- ‘Status’ column now called ‘Sync Status’

- ‘Fees Id’ removed from fees table

- ‘Account Nature’ column added to table with AP, AR or PR, with an information button explaining the types

- Locum and Consultant Fees, along with payables adjustments, say ‘AP’ in this column. Customer fees and receivables adjustments say ‘AR’, Employees and Registrars' "fees" say ‘PR’ in this column.

- Under ‘Type’, wildcard adjustments now just show as ‘Adjustment - Wildcard’, with the AP/AR account nature column indicating the nature of them.

- ‘Type’ of fee is no longer in all capitals

- ‘Amount ex GST’ column removed

- ‘Fee Amount’ column renamed to ‘Clinic Earnings’. This includes AR service fees + GST, PR service fees, PRO amounts, Supplier AP GST and earnings from AP transactions after thw supplier’s fee

- ‘GST on Fees’ column renamed to ‘Clinic Earnings GST’

- Practitioner Earnings GST’ column added

- ‘Fee Journal ID’ column removed

- ‘Statement Number’ column removed

- ‘PMS Date’ column removed

- ‘Matched Fee Used’ is ‘-‘ instead of ‘ADJUSTMENT’ for adjustments

- Note removed columns can still be found in the Fees CSV export.

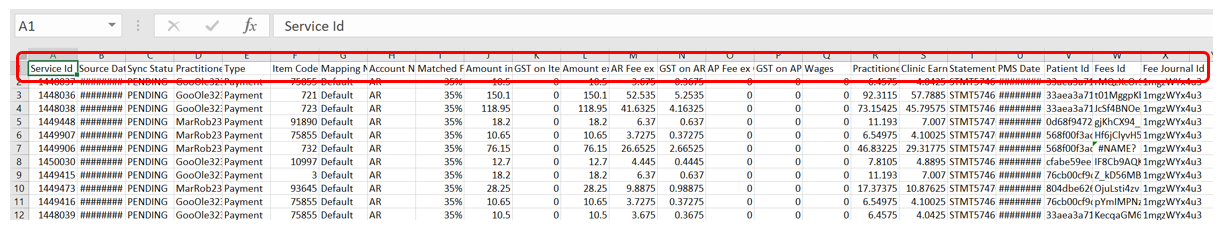

Changes to the Heading in the CSV Export from the Fees Page

- ‘Fee Amount’ column removed

- ‘GST on Fee’ column removed

- ‘Account Nature’ column added

- ‘AR Fee ex GST’ column added

- ‘GST on AR Fee’ column added

- ‘AP Fee ex GST’ column added

- ‘GST on AP Fee’ column added

- Wages column added

- Clinic earnings columns added

- PR goes into AP Fee column, with no AP fee GST

- ‘Status’ -> ‘Sync Status’

- ‘Invoice Number’ -> Service ID

- ‘i.’ removed from the service ID

- ‘Matched Fee Used’ is ‘-‘ instead of ‘ADJUSTMENT’ for adjustments

- Columns reordered

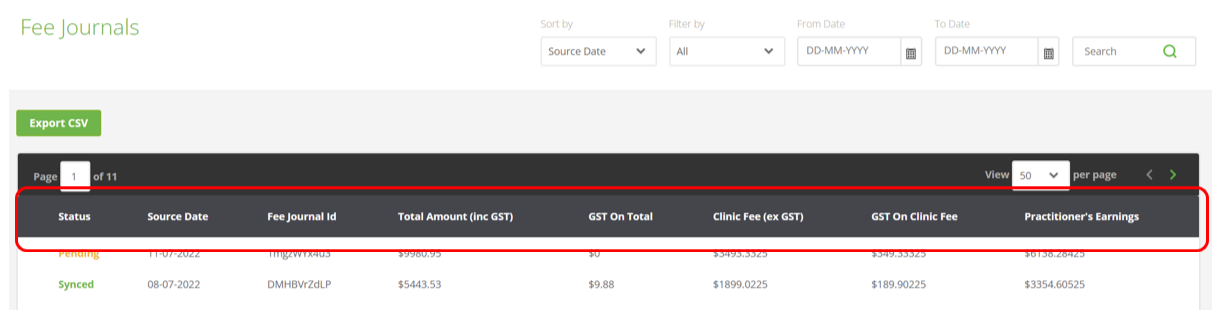

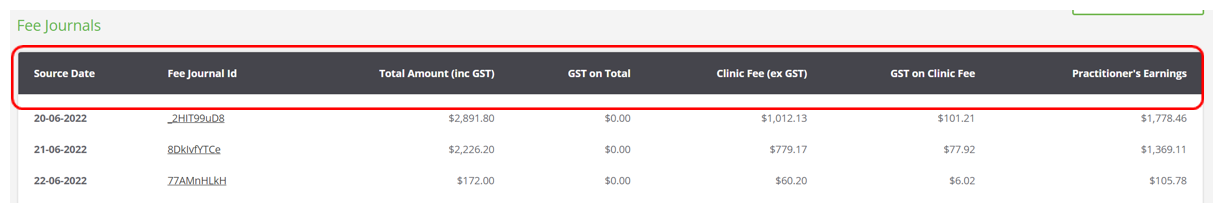

Changes to the Table Headings in the Fees Journal Page

- ‘Service Fees’ -> ‘Clinic Earnings (ex GST)’

- ‘GST on Service Fee’ -> ‘GST on Clinic Fee’

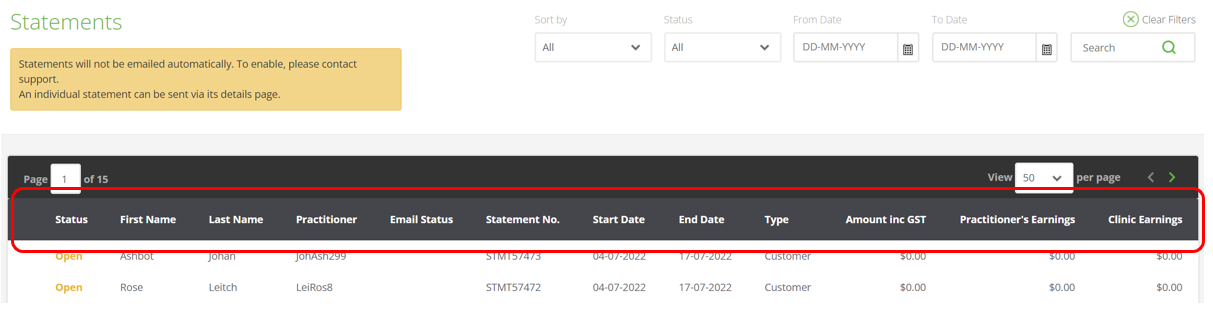

Changes to Table Headings in the Statements Page

- ‘Service Fees’ -> ‘Clinic Earnings’

- ‘Billings inc GST’ -> ‘Amount inc GST’

AP Statement Details Page Changes

- ‘Service Fees’ -> ‘Clinic Earnings (ex GST)’

- ‘GST on Service Fee’ -> ‘GST on Clinic Fee’